Check out the latest from IRS Tax Tips…

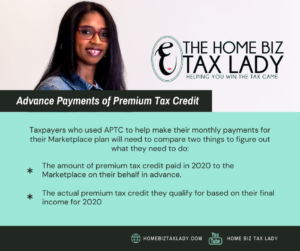

The premium tax credit helps pay for health insurance coverage bought from the Health Insurance Marketplace. Eligible people can choose to have all, some, or none of the estimated credit paid in advance directly to their insurance company on their behalf. These payments – which are called advance payments of the premium tax credit, advance credit payments, or APTC – lower what taxpayers pay out-of-pocket for their monthly premiums.

Alternatively, people can choose not to get APTC, pay the full amount of their monthly premium, and claim all the benefit of the PTC that they are allowed when they file their tax return. This will increase their refund or lower the amount of tax they owe. Taxpayers use Form 8962, Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC.

The American Rescue Plan Act of 2021 suspends the requirement that taxpayers repay their excess advance payments of the premium tax credit for tax year 2020. Excess APTC is the amount by which the taxpayer’s advance payments of the premium tax credit exceed their premium tax credit.

Have questions? Just comment below and let me know how I can help you!